SAP MM for Finance Professionals: Why It Matters

When finance professionals think of SAP modules, SAP FI (Financial Accounting) and CO (Controlling) often come to mind. However, SAP MM (Materials Management) plays an equally critical role in financial processes—especially when it comes to procurement, inventory valuation, invoice verification, and managing the procure-to-pay (P2P) cycle.

Understanding SAP MM from a finance lens helps ensure better control over costs, stronger collaboration with procurement and operations teams, and more accurate financial reporting.

In this post, we’ll break down why SAP MM matters for finance professionals, and how you can effectively navigate its key components to enhance your financial operations.

What is SAP MM?

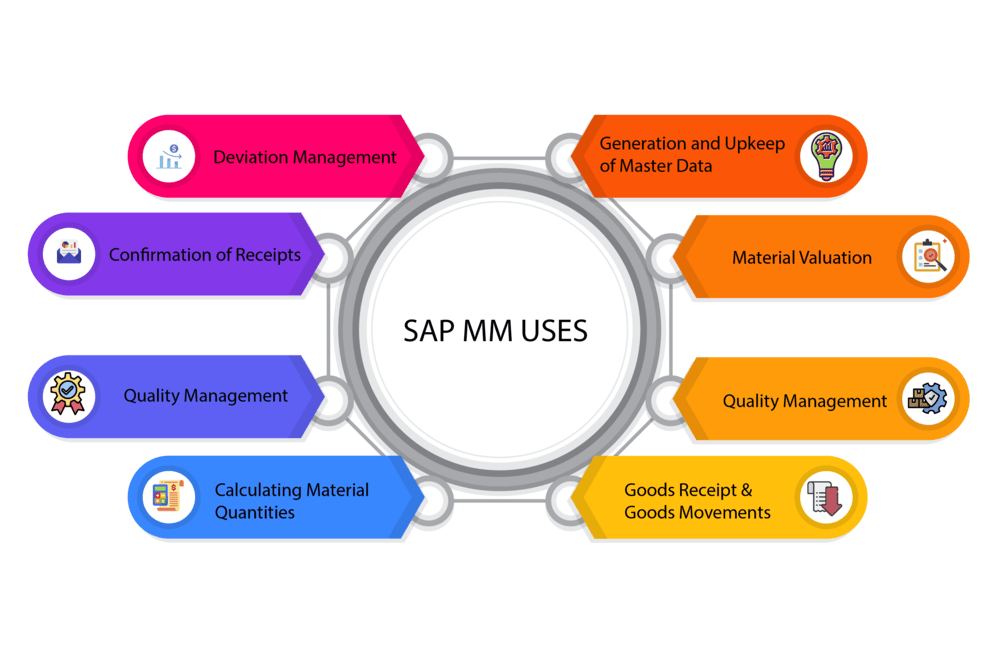

SAP MM (Materials Management) is one of the core modules of the SAP ERP system, primarily used to handle procurement and inventory functions. It ensures materials are available in the right quantity and at the right time, whether for production or customer delivery.

Key MM sub-modules include:

- Purchasing (MM-PUR): Procurement of goods and services.

- Inventory Management (MM-IM): Tracking stock quantities and movements.

- Invoice Verification (MM-IV): Matching invoices with POs and goods receipts.

- Material Master Data: Centralized data management for all materials used in the business.

For finance professionals, the most relevant parts of SAP MM lie at the intersection of procurement, accounting, and invoice processing.

Why Finance Should Care About SAP MM

Finance is deeply connected with procurement operations. Here’s why finance professionals should understand how SAP MM works:

1. Procure-to-Pay Process (P2P)

SAP MM governs the full P2P cycle—from requisition to purchase order (PO), goods receipt (GR), and invoice verification (MIRO). At each step, financial data is generated:

- PO creation triggers a commitment in Controlling (CO).

- Goods receipt posts a GR/IR (Goods Receipt/Invoice Receipt) clearing entry.

- Invoice receipt leads to accounting entries and payment scheduling.

Finance teams must ensure these steps are properly executed to avoid discrepancies between goods received and invoices paid.

2. Accurate Cost Accounting

Incorrect material pricing or GR/IR mismatches can distort actual vs. planned costs. By monitoring SAP MM documents, finance professionals can ensure:

- Correct valuation class is assigned to materials

- Consistent pricing procedures are followed

- GR/IR accounts are regularly cleared

3. Better Budget Control

With integration between MM and CO, POs can be checked against cost centers or internal orders. This helps finance teams enforce budget limits and avoid overspending.

Key SAP MM Transactions Every Finance Professional Should Know

Here are some important SAP MM transactions that intersect with financial processes:

| T-Code | Purpose |

|---|---|

| ME21N | Create Purchase Order |

| MIGO | Post Goods Receipt |

| MIRO | Enter Vendor Invoice |

| MRBR | Release Blocked Invoices |

| MB5S | GR/IR Account Reconciliation |

| ME23N | Display Purchase Order |

| MB52 | Stock Overview |

| ME2K / ME2N | PO Reports by Account Assignment |

Understanding these will help finance users trace the financial trail of each procurement transaction.

MM and FI Integration Points

Let’s explore how SAP MM integrates with Financial Accounting (FI) and Controlling (CO):

1. GR/IR Clearing

When goods are received (MIGO), the system debits inventory (or expense) and credits the GR/IR account.

Inventory A/C (Dr)

GR/IR A/C (Cr)