Financial Accounting in IBM Mainframe

When it comes to processing massive volumes of financial transactions with speed, security, and stability, few platforms can match the legacy and reliability of the IBM Mainframe. Despite the emergence of cloud computing and distributed systems, mainframes still power critical operations in global banks, insurance firms, and government agencies—particularly in the realm of financial accounting.

In this post, we explore how financial accounting is managed on IBM Mainframe systems, the tools and languages involved, and why they continue to play a vital role in modern finance.

What is an IBM Mainframe?

An IBM Mainframe is a high-performance computing platform designed to handle vast data processing needs with unmatched reliability, scalability, and uptime. Mainframes are optimized for:

- High-volume transaction processing (e.g., banking, payroll)

- Batch processing and reporting

- Real-time access with multiple concurrent users

- Regulatory compliance and data security

Some well-known IBM mainframes include System z, z14, z15, and the more recent IBM z16.

Why Use IBM Mainframe for Financial Accounting?

Financial accounting involves recording, summarizing, and reporting financial transactions over time. For large enterprises or financial institutions, this means millions of entries per day—ranging from customer payments to interbank transfers.

IBM Mainframes are ideal for financial accounting because they offer:

- Unmatched reliability (99.999% uptime)

- Support for high-volume batch and online processing

- Secure, auditable environments for compliance

- Integration with legacy and modern financial applications

- High-speed data access and real-time processing

Core Components for Financial Accounting on Mainframes

IBM Mainframes don’t operate in isolation. They utilize a stack of software tools, data layers, and business logic to run financial accounting workloads. Here are some of the key components:

1. COBOL (Common Business-Oriented Language)

- Most financial accounting systems on mainframes are built in COBOL

- Known for its readability and reliability in handling business logic

- Common for writing ledger processing, journal entries, and report generation

2. JCL (Job Control Language)

- Used to submit batch jobs (e.g., nightly financial processing)

- Controls when and how accounting jobs are executed

3. CICS (Customer Information Control System)

- Enables real-time transaction processing

- Often used for user-facing accounting operations like account balance inquiries or journal entry updates

4. DB2 for z/OS

- IBM’s high-performance relational database system

- Stores accounting data like general ledger, subledgers, customer transactions

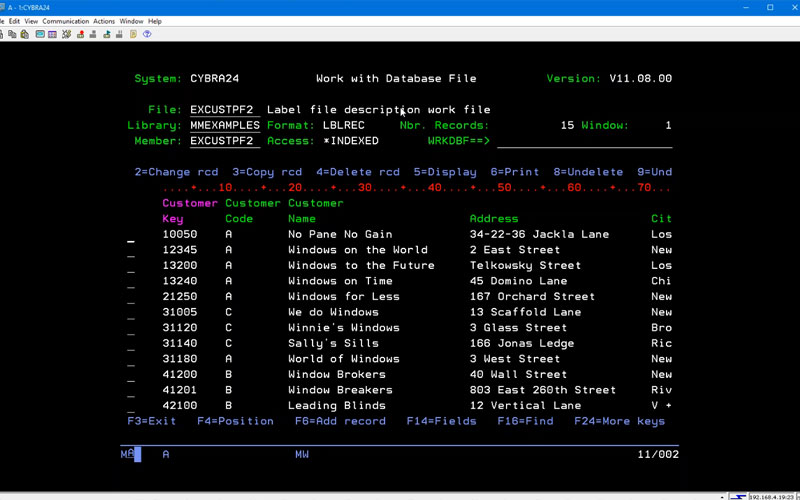

5. VSAM (Virtual Storage Access Method)

- File management system used in older or high-performance accounting applications

- Still widely used for storing transaction logs and audit files

Financial Accounting Workflow on IBM Mainframe

A typical financial accounting process on a mainframe might include:

1. Data Collection

- Transactions are captured from multiple systems (e.g., branches, ATMs, ERP)

- Data is written to VSAM files or DB2 tables

2. Journalizing and Ledger Posting

- COBOL programs process entries and validate accounting rules

- Entries are posted to subledgers and general ledger in batch or real-time

3. Reconciliations

- Automatic or manual processes check balances between modules

- Exception reports generated using JCL jobs

4. Financial Reporting

- Trial balances, income statements, and balance sheets generated

- Reports may be exported to Excel, PDF, or consumed by BI tools

5. Audit Logging and Compliance

- All financial entries are logged for traceability

- Often required by SOX, IFRS, or local accounting standards

Advantages of Mainframe-Based Financial Accounting

- Stability – Mainframes can run for years without downtime

- Speed – Millions of transactions can be processed in seconds

- Security – Role-based access, data encryption, and built-in audit trails

- Longevity – Systems built 30+ years ago still work efficiently

- Regulatory Readiness – Ideal for highly-regulated sectors like banking and insurance

Common Use Cases

Banking and Credit Unions

- Daily batch processing of transactions

- Core banking accounting systems (GL, subledger, loan reconciliation)

Insurance Companies

- Premium postings, claims accounting, actuarial data management

Government and Public Sector

- Treasury and disbursement processing

- Fund and grant accounting

Large Enterprises

- Payroll processing

- Financial close and consolidation

Challenges with IBM Mainframe Accounting

While mainframes remain powerful, they come with challenges:

Talent Shortage – COBOL and mainframe skills are aging and scarce

Modernization Costs – Integration with cloud or modern ERP systems can be expensive

Complexity – Systems are often monolithic and hard to decouple

Limited Flexibility – Changes can require lengthy test and deployment cycles

Modernization Strategies

Organizations aren’t always looking to replace mainframes but rather extend or modernize them. Some common approaches include:

API Enablement

Expose mainframe financial functions (e.g., GL posting) as APIs to integrate with cloud apps.

Hybrid Architecture

Use mainframe for core processing and cloud for reporting, dashboards, or ML forecasting.

Microservice Wrappers

Encapsulate legacy accounting modules in microservices for modular deployment.

Skill Bridging

Train younger developers in COBOL or use modern wrappers like IBM Z Open Editor (VS Code plugin).

Real-World Example

Global Bank XYZ processes 25 million financial transactions per day through their IBM Mainframe. Their general ledger runs on COBOL programs that post data into DB2 and reconcile entries every hour. Reports are generated using JCL nightly and pushed to a Power BI dashboard through data extracts.

By combining COBOL logic with modern analytics, they have reduced close times by 40% without moving away from mainframes.

Final Thoughts

IBM Mainframes have long powered the financial systems of the world—and they continue to play a mission-critical role in financial accounting, especially where high volume, reliability, and security are essential.

For finance professionals, understanding how accounting works in a mainframe environment is a valuable asset—especially in industries like banking, insurance, and government where these systems remain dominant.

While modernization is underway in many places, the mainframe is here to stay—evolving from a standalone legacy system into a powerful player in hybrid financial architectures.