Excel Functions Every Finance Pro Should Know

When it comes to financial analysis, budgeting, and reporting, Microsoft Excel remains the undisputed champion. Despite the rise of sophisticated analytics tools, Excel continues to be the go-to solution for finance professionals. But what really makes Excel powerful isn’t just its grids and charts—it’s the functions behind the scenes.

In this blog post, we’ll explore the top Excel functions every finance professional should master. Whether you’re a financial analyst, accountant, or FP&A specialist, these functions will help you work faster, smarter, and with greater accuracy.

Why Excel Skills Matter in Finance

Finance professionals are expected to handle tasks like:

- Forecasting revenue and expenses

- Creating financial models

- Preparing dashboards and reports

- Analyzing large volumes of data

- Reconciling transactions

Excel functions can automate these tasks, reduce errors, and give you a competitive edge in your career.

1. SUM, SUMIF, and SUMIFS

These are foundational for any kind of financial summation.

-

=SUM(A1:A10)

Adds up all numbers in cells A1 through A10. -

=SUMIF(A1:A10, ">100")

Sums only values greater than 100. -

=SUMIFS(B2:B100, A2:A100, "Sales", C2:C100, ">1000")

Sums values in B2:B100 where column A is “Sales” and column C is greater than 1000.Use case: Summing expenses by category, revenue by product, or salaries by department.

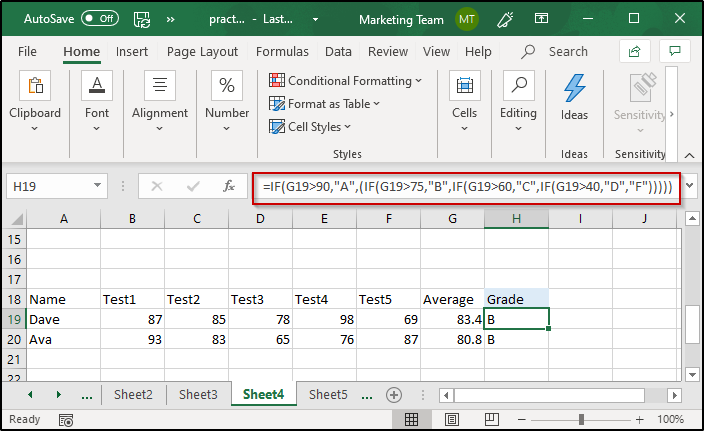

2. IF, IFS, and Nested IF

Conditional logic is crucial in finance—enter the IF function.

-

=IF(A1>1000, "High", "Low")

Returns “High” if A1 > 1000, otherwise “Low”. -

=IFS(A1<500, "Low", A1<1000, "Medium", A1>=1000, "High")

Multiple conditions in a cleaner format.Use case: Bonus eligibility, categorizing accounts, assigning credit risk ratings.

3. VLOOKUP, HLOOKUP, and XLOOKUP

Searching for values is common in reconciliation or mapping tasks.

-

=VLOOKUP("A101", A2:D100, 3, FALSE)

Looks for A101 in the first column of the range and returns the value from the 3rd column. -

=XLOOKUP("A101", A2:A100, C2:C100)

More powerful and flexible than VLOOKUP; doesn’t require sorted data.Use case: Mapping GL codes to account names, fetching cost center details, or validating vendor information.

4. INDEX + MATCH

Often preferred over VLOOKUP for dynamic lookups.

=INDEX(B2:B100, MATCH("ABC", A2:A100, 0))

MATCH finds the position of “ABC” in column A

INDEX returns the value at that position from column B

Use case: Data retrieval from dynamic reports or when lookup column is not the first.

5. TEXT and TEXTJOIN

Formatting numbers, dates, and strings properly is essential.

=TEXT(A1, "dd-mmm-yyyy") → 01-Jan-2025

=TEXTJOIN(", ", TRUE, A1:A5) → Joins text with commas

Use case: Creating readable dates, custom number formats, or merging address lines.

6. LEFT, RIGHT, MID, and LEN

For text parsing and string manipulation.

=LEFT(A1, 3) → First 3 characters

=RIGHT(A1, 4) → Last 4 characters

=MID(A1, 2, 3) → 3 characters starting from position 2

=LEN(A1) → Length of the text

Use case: Extracting account numbers, branch codes, or prefixes from data.

7. CONCATENATE / CONCAT / &

Combining values from different cells:

=A1 & " - " & B1

Or using =CONCAT(A1, " ", B1)

Use case: Creating unique IDs or full names, combining codes.

8. ROUND, ROUNDUP, ROUNDDOWN

Rounding is essential in financial reporting.

=ROUND(A1, 2) → Round to 2 decimal places

=ROUNDUP(A1, 0) → Always round up

=ROUNDDOWN(A1, 0) → Always round down

Use case: Formatting currency values, rounding interest calculations.

9. NOW, TODAY, and EOMONTH

Date functions are critical for interest calculations, deadlines, and reporting periods.

=TODAY() → Current date

=NOW() → Current date and time

=EOMONTH(TODAY(), 0) → End of the current month

Use case: Calculating due dates, fiscal periods, or age of receivables.

10. IFERROR and ISERROR

Trap and handle errors gracefully.

=IFERROR(VLOOKUP(...), "Not Found")

Use case: Preventing #N/A, #VALUE!, or #DIV/0! errors from breaking dashboards or reports.

11. COUNT, COUNTA, COUNTIF, COUNTIFS

Used to count cells based on different criteria.

=COUNT(A1:A10) → Only numbers

=COUNTA(A1:A10) → Numbers + text

=COUNTIF(A1:A10, ">1000") → Count cells greater than 1000

=COUNTIFS(A1:A10, ">1000", B1:B10, "Approved")

Use case: Counting high-value invoices, approved requests, or valid entries.

12. PMT and NPV

Finance-specific functions for cash flow and interest calculations.

=PMT(rate, nper, pv)

E.g., =PMT(0.05/12, 60, -10000) → Monthly payment for a 5-year loan

=NPV(rate, value1, [value2]...)

Calculates the net present value of a series of cash flows.

Use case: Loan schedules, investment analysis, project viability checks.

13. DATA VALIDATION and Named Ranges

While not a function per se, data validation is key for:

Drop-down lists

Restricting data types

Improving model accuracy

Named ranges make formulas easier to read:

=SUM(Salary_2024)

Use case: Creating clean and error-proof templates.

Excel Tips for Finance Professionals

Always use absolute references ($A$1) when needed Use named ranges for cleaner formulas Document your work with comments or a README sheet Avoid hardcoding values—reference cells instead Use conditional formatting for alerts or highlights

Bonus: Excel Add-Ins for Finance Power Query → For data cleaning and transformation

Power Pivot → Advanced modeling with large data sets

Solver → Optimization problems (e.g., max profit, min cost)

Analysis ToolPak → Regression, histogram, and stats

Conclusion

Mastering these Excel functions can make a huge difference in your efficiency and effectiveness as a finance professional. From building financial models to reconciling statements and preparing investor-ready reports, these tools give you the analytical edge you need.

Spend time practicing these formulas in real-world scenarios and watch your productivity soar. Excel isn’t just a spreadsheet—it’s a powerful financial toolkit in the right hands.