Managing Expenses with Spendesk: A Complete Guide

In today’s digital finance landscape, managing business expenses efficiently is crucial for growth and sustainability. Manual expense reports, endless paper trails, and delayed reimbursements are rapidly becoming outdated. Enter Spendesk—a modern spend management platform that transforms how companies control, track, and optimize their expenses.

Whether you’re a finance professional, startup founder, or operations lead, this blog post explores how Spendesk simplifies expense management, improves transparency, and empowers teams with real-time financial insights.

What is Spendesk?

Spendesk is a cloud-based spend management solution designed for small and medium-sized businesses. It streamlines every aspect of business spending—from request and approval to payment and reconciliation.

Spendesk offers:

- Virtual and physical payment cards

- Automated expense reports

- Real-time budgeting tools

- Centralized invoice tracking

- Secure team payments with built-in controls

It’s a single platform for managing all company spending—subscriptions, travel, team purchases, and vendor payments—without relying on traditional, fragmented systems.

Why Businesses Choose Spendesk

Spendesk is built with modern finance teams in mind. Here’s why it’s increasingly adopted across Europe and beyond:

-

- User-friendly Interface

-

- Real-time Visibility of Spending

-

- No More Manual Receipts or Paperwork

-

- Faster Month-end Closings

-

- Empowers Employees While Retaining Control

-

- Integrates with Accounting Software (Xero, QuickBooks, DATEV)

Key Features of Spendesk

1. Smart Company Cards (Virtual + Physical)

With Spendesk, you can issue smart payment cards to employees with spending limits and category controls. These cards help:

- Control spending by team, project, or user

- Capture receipts instantly via mobile

- Prevent fraud or misuse with real-time authorization

Virtual cards are ideal for online subscriptions, while physical cards are great for travel and team purchases.

2. Pre-approval Workflows

Tired of unauthorized expenses? Spendesk includes customizable approval workflows:

- Employees request funds with a reason and budget tag

- Managers approve or reject in one click

- All approvals are logged for transparency

This eliminates the need for back-and-forth emails and ensures budget discipline.

3. Receipt Capture & Reconciliation

Receipts can be uploaded via the mobile app, email, or browser extension. Spendesk:

- Matches receipts to transactions automatically

- Sends reminders for missing documentation

- Flags anomalies or duplicates

This drastically reduces the time spent chasing employees during month-end close.

4. Invoice Management

Track and pay supplier invoices directly from Spendesk:

- Upload or forward invoices for review

- Assign budget and cost center

- Route for multi-step approvals

- Pay via SEPA or integrated bank transfer

No more lost invoices or delayed payments to vendors.

5. Real-Time Spend Tracking & Budgets

Finance teams get access to:

- Spend by department, user, project, or vendor

- Live dashboards and exportable reports

- Budget tracking and alerts when thresholds are crossed

This ensures complete visibility and better cash flow planning.

6. Integration with Accounting Software

Spendesk integrates with:

- Xero

- QuickBooks

- Sage

- DATEV (Germany)

Export pre-coded transactions, matched with receipts and VAT details—saving hours of manual bookkeeping.

Spendesk vs. Traditional Expense Management

| Feature | Traditional Tools (Excel/ERP) | Spendesk |

|---|---|---|

| Paperless Receipts | Manual Uploads | Yes |

| Real-Time Expense Tracking | Delayed | Instant |

| Pre-approvals | Rarely Used | Integrated |

| Employee Empowerment | Limited | Smart Cards |

| Month-End Close | Time-Consuming | Streamlined |

| Accounting Integration | Export/Import Hassle | Seamless |

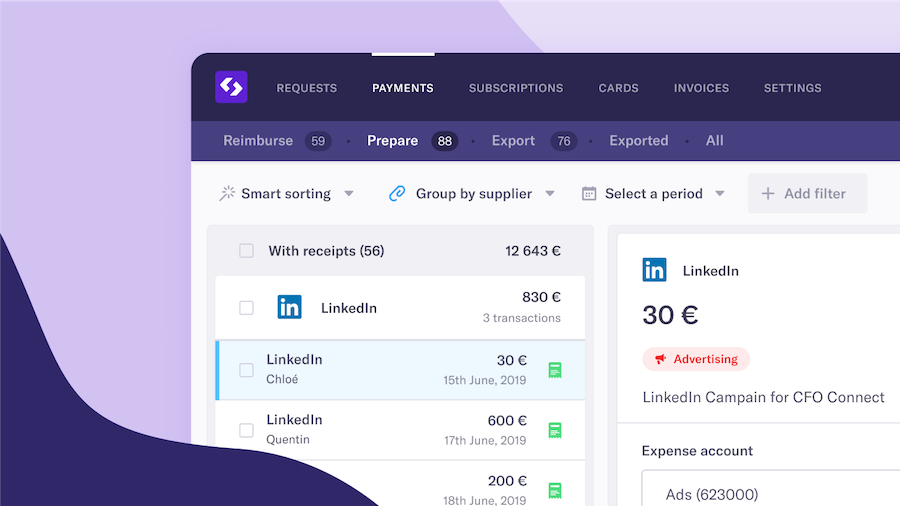

Spendesk in Action: A Use Case

Let’s walk through a real-world use case:

Scenario:

Emma, a Marketing Manager, needs to run a paid campaign on LinkedIn for €1,000.

- Using Spendesk:

- Emma logs in and requests €1,000 via virtual card.

- Her manager approves it instantly via mobile.

- A single-use virtual card is generated and used for LinkedIn Ads.

- The receipt is uploaded via the browser extension.

- Finance team sees it coded to the Marketing > Advertising budget.

- At month-end, the expense is already approved, categorized, and ready for export.

No emails. No Excel sheets. No follow-ups.

Security & Compliance

Spendesk is built with finance-grade controls:

- Role-based access and approval hierarchies

- Audit-ready reports with digital logs

- Bank-grade encryption for all data

- ISO 27001-certified infrastructure

Plus, Spendesk offers multi-factor authentication and compliance with GDPR and financial regulations.

Benefits for Different Stakeholders

For Finance Teams

- Close books faster

- Automate reconciliation

- Ensure policy compliance

- Focus on strategy, not admin

For Managers

- Approve requests on-the-go

- Stay within budget

- Gain real-time visibility into team spending

For Employees

- No out-of-pocket payments

- Easy mobile receipt uploads

- Quick access to company funds

Pricing and Plans

Spendesk typically offers:

- Starter Plans for small teams

- Growth Plans with multi-user and accounting features

- Custom Enterprise Plans with advanced controls

Pricing depends on:

- Number of users

- Monthly spend volume

- Feature access (e.g., cards, invoicing, integrations)

You can request a demo or get a free trial to explore it firsthand.

Spendesk vs. Other Tools

| Platform | Focus Area | Ideal For |

|---|---|---|

| Spendesk | All-in-one spend management | SMEs with multiple spend needs |

| Expensify | Receipt scanning & mileage | Freelancers, consultants |

| Pleo | Smart company cards | Small businesses |

| Brex | Startup corporate cards | US-based startups |

| SAP Concur | Enterprise expense mgmt | Large organizations |

Spendesk is best suited for European businesses and teams looking for a centralized spend control system.

Learning & Support

To help you get started, Spendesk offers:

- Onboarding Webinars

- Help Center & Knowledge Base

- Live Chat Support

- Spendesk Academy – Tips, guides, and certifications

They also host community events like CFO Connect, where finance professionals share best practices.

Conclusion

Managing business expenses doesn’t have to be chaotic or time-consuming. Spendesk offers a powerful yet simple way to track, approve, pay, and reconcile all company spend in one place.

By using Spendesk:

- Finance teams gain control

- Employees get autonomy

- Leaders get real-time visibility

If your business struggles with delayed reimbursements, poor spend visibility, or painful month-end closures, it’s time to upgrade your expense management with Spendesk.